Default information of vendors

Peach tree let you set up the default information of

the vendors. You can edit the options which have in the vendor’s window. You

can make your own option that is called the default information of vendors.

Once you have made your vendors and gave them some options e.g.: the discount

terms etc, now you can make some feature like a template or

model upon which to build all your vendors records. From this you enter the most common information. The objective

of default information is when you set up new vendors and enter transactions

the default information is automatically included. Once you have entered the

default information you don’t need to enter any specific information separately

for each new vendor except the name and address. All other information will be

entered and you are ready to record.

This window has different options which you can use

to set the default information. If you select any option as default in this

window then the related options in the vendors account are also edited as per

accordance with the vendors default window. To enter the default information,

open the maintain drop down menu select the option default information and from

that list select vendors. After you will click on vendor option a new window

will open as shown in figure:

After

clicking the option vendors…. The following screen will open:

Payment Terms:

In

this tab of vendor defaults there are the standard terms for the vendors:

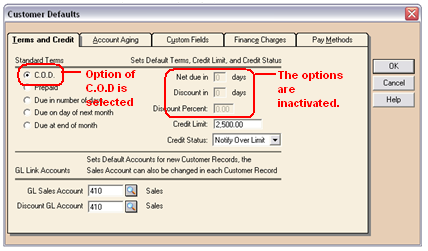

COD:

Cash

on demand. This means that the purchase will not be on credit but the cash will

be paid at the time of receiving goods/ raw material. If you select this

option, then the option of “net due in”, “Discount in” and “Discount percent”

will be inactivated. As shown in figure:

Prepaid: You

select this option when the cash is already paid for the goods not received yet.

If you select this option, then the option of “Net due in”, Discount in” and

Discount percent will be inactivated. As shown in figure:

Due in number of

days: When you make purchases on credit you receive

discount from your vendors and they make some conditions and terms, such as they

make terms on the basis of payment due in number of days. For example, net

payment is due in 30 days, the discount will be received if the payment will be

paid in 10 days then the discount will be allowed 2%. You also specify the

credit limit for example: 2,500. You make a limit that you can make credit purchase

up to the specified limit of credit. If the of credit exceeds beyond this

prescribed limit then an error will be displayed on the screen while recording

the invoice balance.

In

this tab more information you gave is the GL purchase account and the Discount

GL account that is purchase account.

Due on day of

next month: This option is selected when the credit

amount is payable on the day of next month of the purchase. The net due which

was day in the previous option is in month here. All the information will

remain same.

Due at the end

of the month: We select this option when the payment

is due at the end of the month in which the purchase is made. Due in net option

will be inactivated when you select the option at the end of the month. As

shown in below figure:

Account aging:

We

use this option to make the different categories for the creditors. From this we

can make the estimate that how early and efficiently we can make our payables.

Aging can be made on the basis of “Invoice Date” or “Due Date”.

If

we select the option of “Invoice Date” it means that the aging of the vendor

will be start when the invoice is received from the vendor. And if we select

the option of the Due Date, then the aging of the vendor will be started after

the days given by vendor for payment. For an example, if the vendor has issued

the invoice on 12th February, the day of selling goods, we selected

the option of invoice the aging of that vendor will be start on 12th

February. If we have selected the option due date and the vendor’s due date is

15th February then the aging of the vendor will be after 15th

February.

Custom fields:

The

custom field can be use to enter extra information about the vendors. The

fields mention in the below window can be used to label them on all of your vendors.

We can also add the further more field labels as per required in the 4th

and 5th option.